What is the Difference Between Car Insurance and Personal Accident Insurance?

When it comes to safeguarding yourself and your assets, insurance plays a pivotal role. However, navigating through the various insurance types can be confusing. One common area of confusion is distinguishing between car insurance and personal accident insurance. Let’s break down the key differences to help you make informed decisions about your coverage.

Understanding Car Insurance:

Car insurance, as the name suggests, primarily focuses on providing coverage for your vehicle. It is a comprehensive policy that encompasses various aspects related to your car. Here are the key features:

- Vehicle Protection: Car insurance protects your vehicle from damages caused by accidents, collisions, theft, fire, and natural disasters.

- Third-Party Liability: It covers the costs incurred due to injuries, death, or property damage to third parties if you are at fault in an accident.

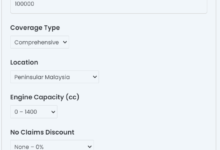

- Comprehensive Coverage: Many car insurance policies offer comprehensive coverage, including protection against vandalism, windshield damage, and compensation for assessed repair time.

Understanding Personal Accident Insurance:

On the other hand, personal accident insurance is designed to provide coverage for you and your passengers in the event of accidents. Here are the key features:

- Personal Injury Coverage: Personal accident insurance focuses on providing financial support in case of bodily injuries, disabilities, or death resulting from an accident.

- Medical Expenses: It covers medical expenses, including hospitalization, surgeries, and rehabilitation, arising from an accident.

- Loss of Income: In the unfortunate event of a disability preventing you from working, personal accident insurance may provide compensation for the loss of income.

Understanding the nuanced details of both car insurance and personal accident insurance is crucial for making informed decisions about your coverage needs. By considering the specific features and benefits of each type, you can tailor your insurance portfolio to provide comprehensive protection for yourself and your assets.

FAQs on the Difference Between Car Insurance and Personal Accident Insurance:

Car insurance is essential for protecting your vehicle and covering third-party liabilities. Personal accident insurance focuses specifically on bodily injuries and may not cover other aspects of an accident.

No, personal accident insurance cannot replace car insurance. Car insurance provides comprehensive coverage for your vehicle, including damages, theft, and third-party liabilities.

While health insurance covers medical expenses, personal accident insurance provides additional coverage for specific accident-related scenarios, such as disability and loss of income.

Car insurance primarily covers damages to the vehicle and third-party liabilities. Personal accident insurance is designed to cover injuries to you and your passengers in case of an accident.

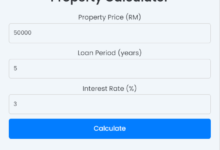

The cost of car insurance is influenced by factors such as the vehicle’s make and model, the driver’s age and experience, claims history, and the coverage type (comprehensive or third-party).

Personal accident insurance is specifically designed for injuries resulting from accidents. Non-accident-related injuries are typically covered by health insurance.

Yes, personal accident insurance can be purchased separately from car insurance. It is a standalone policy that focuses on providing coverage for personal injuries resulting from accidents, irrespective of the vehicle involved.