What is Motor Insurance Malaysia?

Motor insurance, also known as car insurance or auto insurance, is a financial product that provides coverage for vehicles against various risks and liabilities. It is a contract between the vehicle owner and the insurance company, where the owner pays a premium in exchange for the insurer’s promise to cover specified financial losses related to the vehicle.

Types of Motor Insurance

Motor insurance typically comes in several types, each designed to cater to different needs and levels of coverage. Here are some common types of motor insurance:

- Third-party Liability Insurance: This is the most basic form of motor insurance and is mandatory in many jurisdictions. It covers damages and injuries caused to third parties (other people, vehicles, or property) by your vehicle. However, it does not cover damages to your own vehicle.

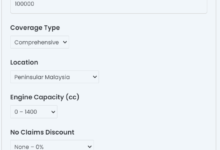

- Comprehensive Insurance: Comprehensive insurance provides coverage for damages to your own vehicle as well as third-party liabilities. It typically covers theft, vandalism, fire, natural disasters, and accidents.

- Collision Insurance: Collision insurance covers damages to your vehicle caused by collisions with another vehicle or object, regardless of fault. This type of insurance is often purchased in addition to comprehensive insurance.

- Personal Injury Protection (PIP) or Medical Payments Coverage: PIP or medical payments coverage pays for medical expenses incurred by you and your passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This type of insurance protects you if you’re involved in an accident with a driver who either has no insurance or insufficient insurance to cover your damages.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease. This can be useful if your vehicle is totaled and you owe more on it than its depreciated value.

- Towing and Labor Coverage: This coverage pays for towing and labor costs if your vehicle breaks down or needs assistance on the road.

- Rental Reimbursement Coverage: Rental reimbursement coverage pays for the cost of renting a car while your vehicle is being repaired due to a covered loss.

The availability and specifics of these types of motor insurance can vary depending on your location and the insurance provider. It’s essential to carefully review your policy and consult with an insurance agent to ensure you have the coverage that meets your needs.

Coverage Features

Coverage features in motor insurance refer to the specific protections and benefits included in a policy. These features can vary depending on the type of coverage you select and the insurance provider. Here are some common coverage features found in motor insurance policies:

- Liability Coverage: Provides financial protection if you are responsible for injuring someone else or damaging their property in an accident.

- Collision Coverage: Pays for repairs to your vehicle if it’s damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage: Pays for medical expenses resulting from an accident, regardless of fault.

- Property Damage Liability: Covers damage you cause to someone else’s property with your vehicle.

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal expenses if you injure someone in an accident.

- Roadside Assistance/Towing: Provides assistance if your vehicle breaks down, including towing services, jump-starts, flat tire changes, and fuel delivery.

- Rental Car Reimbursement: Pays for the cost of renting a car while your vehicle is being repaired due to a covered loss.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease if your vehicle is totaled.

- New Car Replacement: Replaces your vehicle with a new one of the same make and model if it’s totaled within a certain time frame (typically one to three years) of purchase.

- Accident Forgiveness: Protects your premium from increasing after your first at-fault accident.

- Loss of Use: Reimburses you for alternative transportation expenses (e.g., rental car, public transportation) while your vehicle is being repaired due to a covered loss.

- Custom Parts and Equipment Coverage: Provides coverage for aftermarket parts and accessories installed on your vehicle.

These coverage features can be customized based on your needs and budget, and it’s essential to review them carefully when purchasing motor insurance to ensure you have adequate protection.

No Claim Discount (NCD):

No Claim Discount (NCD), also known as No Claims Bonus (NCB), is a reward system offered by insurance companies to policyholders who do not make any claims on their insurance policies within a specified period. Here’s how it generally works:

- Accumulation of NCD: For each year that a policyholder goes without making a claim, they earn a No Claim Discount. The discount typically accumulates annually, with higher discounts offered for consecutive claim-free years.

- Reduction in Premium: The NCD results in a reduction in the policyholder’s insurance premium at renewal. The discount is applied as a percentage reduction on the base premium, meaning the more claim-free years, the higher the discount and subsequent reduction in premium.

- Transferability: In many cases, the NCD can be transferred between insurance providers when switching policies or vehicles. This allows policyholders to maintain their discount even if they change insurers.

- Maximum Discount: There’s usually a maximum NCD percentage that can be earned, typically ranging from 50% to 70%, depending on the insurer. Once this maximum discount is reached, further claim-free years may not result in additional discounts.

- Impact of Claims: Making a claim typically results in the loss of some or all of the accumulated NCD. The amount of NCD lost varies depending on the insurer and the circumstances of the claim. In some cases, certain types of claims, such as those involving windshield repair or no-fault accidents, may not affect the NCD.

No Claim Discount serves as an incentive for safe driving and responsible behavior on the road, rewarding policyholders who avoid accidents and claims. It encourages drivers to drive carefully and helps to keep insurance premiums affordable for those who demonstrate low risk.

Additional Coverage Options

In addition to the standard coverage options mentioned earlier, there are several additional coverage options that insurance companies may offer to enhance your motor insurance policy. These additional coverage options can provide additional protection and peace of mind in specific situations. Some of these additional coverage options include:

- Emergency Roadside Assistance: Provides assistance if your vehicle breaks down, including services such as towing, jump-starting a battery, changing a flat tire, fuel delivery, and locksmith services.

- Glass Coverage: Covers repair or replacement costs for damaged windows or windshields, often without a deductible.

- Extended Liability Coverage: Offers higher limits for bodily injury and property damage liability coverage beyond the minimum required by law.

- Loss of Use Coverage: Reimburses you for the cost of alternative transportation (such as a rental car) while your vehicle is being repaired due to a covered loss.

- Personal Effects Coverage: Covers the loss or damage of personal belongings kept inside the insured vehicle, such as clothing, electronics, or luggage, in the event of theft, fire, or other covered incidents.

- Accidental Death and Dismemberment Coverage: Provides a lump-sum payment or benefits in the event of accidental death or serious injury resulting from a covered accident.

- Key Replacement Coverage: Covers the cost of replacing lost, stolen, or damaged vehicle keys, including electronic key fobs and programming costs.

- Custom Equipment Coverage: Offers coverage for aftermarket accessories, modifications, or customizations added to the vehicle, such as stereo systems, spoilers, or custom paint jobs.

- New Car Replacement Coverage: Replaces your vehicle with a new one of the same make and model if it’s totaled within a certain period (usually one to three years) of purchase.

- Gap Insurance: Pays the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease if your vehicle is totaled in an accident.

- Pet Injury Coverage: Covers veterinary expenses if your pet is injured while riding in your vehicle during a covered accident.

- Waiver of Deductible: Waives the deductible amount for certain types of claims, such as windshield repair or when the at-fault party is unknown or uninsured.

These additional coverage options can vary depending on the insurance provider and the specific policy. It’s essential to review your options carefully and discuss them with your insurance agent to ensure you have the coverage that meets your needs and preferences.

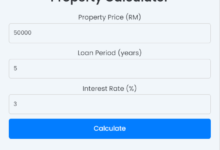

Premium Calculation Factors?

Premium calculation in motor insurance involves various factors that insurers use to assess the risk associated with insuring a vehicle and determine the cost of coverage. While specific factors and their relative importance may vary between insurers and jurisdictions, here are some common factors considered in premium calculation:

- Vehicle Type and Model: The make, model, age, value, engine size, and safety features of the vehicle are significant factors. Vehicles with higher values or those considered to be at higher risk of theft or damage typically have higher premiums.

- Vehicle Usage: The primary use of the vehicle, such as personal use, commuting, business use, or commercial use, affects the premium. Vehicles used for commercial purposes or extensive daily commuting may have higher premiums due to increased exposure to risk.

- Driver’s Age and Gender: Younger and inexperienced drivers generally face higher premiums due to their higher risk of accidents. Gender may also be a factor in some jurisdictions, with male drivers typically facing higher premiums.

- Driver’s Driving History: A driver’s history of accidents, traffic violations, and claims history significantly impacts the premium. Drivers with a clean driving record typically receive lower premiums, while those with a history of accidents or violations may face higher premiums.

- Location: The location where the vehicle is primarily parked or driven affects the premium. Areas with higher traffic congestion, crime rates, or accident rates may have higher premiums due to increased risk.

- Coverage Type and Limits: The type and extent of coverage selected, such as liability-only coverage or comprehensive coverage, as well as the coverage limits chosen, influence the premium. More extensive coverage and higher limits typically result in higher premiums.

- Deductibles: The deductible amount chosen by the policyholder affects the premium. A higher deductible typically results in a lower premium, as the policyholder agrees to pay more out of pocket in the event of a claim.

- No Claim Discount (NCD): Policyholders who have a history of claim-free years may be eligible for a no-claim discount, resulting in lower premiums.

- Credit History: In some jurisdictions, insurers may consider the policyholder’s credit history as a factor in determining premiums. A good credit history may result in lower premiums, while a poor credit history may lead to higher premiums.

- Additional Coverage Options: The inclusion of optional coverage options, such as roadside assistance, rental reimbursement, or gap insurance, may increase the premium.

Insurers use complex algorithms and actuarial analysis to assess these factors and calculate premiums accurately. It’s essential for policyholders to provide accurate information and review their coverage options carefully to ensure they have adequate protection at a competitive price.

Renewal Process:

The renewal process for motor insurance typically involves several steps and considerations:

- Notification: Insurance companies usually notify policyholders before their policy expiration date, informing them that their policy is up for renewal. This notification may come via mail, email, or through the insurer’s online portal.

- Review of Policy: Before the renewal date, policyholders should review their current policy to understand their coverage, limits, deductibles, and any additional features or riders they may have.

- Assessment of Needs: It’s essential for policyholders to reassess their insurance needs before renewal. Factors such as changes in vehicle usage, drivers, or location may impact coverage requirements.

- Comparison Shopping: It’s a good practice to shop around and compare quotes from multiple insurance providers to ensure that you’re getting the best coverage at a competitive price. This may involve reaching out to different insurers directly or using online comparison tools.

- Renewal Options: Policyholders have the option to renew their policy with their current insurer or switch to a different provider if they find a better deal. Some insurers may offer incentives or discounts for renewing policies.

- Payment: Policyholders need to ensure timely payment of the renewal premium to avoid a lapse in coverage. Payment options may include online payment, check, credit card, or automatic bank transfer.

- Documentation: Once the premium is paid, the insurer will issue a renewed policy document, which includes updated coverage details, terms, and conditions. Policyholders should review this document carefully to ensure accuracy.

- No Claim Discount (NCD): If applicable, policyholders with a no-claim discount may need to provide proof of their claim-free history to retain or apply the discount to the renewed policy.

- Renewal Confirmation: Upon renewal, the insurer typically sends a confirmation of the renewed policy, either electronically or by mail. This confirmation serves as proof of insurance coverage.

- Continuous Coverage: It’s crucial for policyholders to maintain continuous insurance coverage to comply with legal requirements and avoid penalties or fines for driving uninsured.

By following these steps and staying proactive in the renewal process, policyholders can ensure that they have adequate coverage and peace of mind on the road.

Last Word: Motor insurance is a legal requirement in many countries, including Malaysia, where it helps ensure financial protection for both vehicle owners and third parties in case of accidents or unforeseen events. Understanding the coverage options, features, and renewal processes is crucial for responsible vehicle ownership.

First of all I would like to say superb blog! I had a quick question which

I’d like to ask if you do not mind. I was inrerested to find out hoow you cenfer yourself and clear

your thoughts before writing. I’ve had a hard tim clearikng my mind in gstting my ideas out there.

I do take pleasure in writing but it just seems like the first 10 to 15 minutes tend to be lost just teying to figure out how to begin. Any suggestions or tips?

Cheers!