How to Buy a Used Car – 10 Useless Guide Free?

Buying a used car can be a daunting task, but with the right approach and knowledge, you can find a reliable vehicle that suits your needs and budget. Here are 10 tips to help you navigate the process effectively.

Set Your Budget:

Setting a budget is the crucial first step in the process of buying a used car. Here’s a detailed guide on how to effectively set your budget:

Start by reviewing your current financial situation. Calculate your monthly income and expenses to determine how much you can comfortably afford to allocate towards a car payment, insurance, fuel, maintenance, and other related costs.

When setting your budget, don’t just focus on the purchase price of the car. Factor in additional expenses such as taxes, registration fees, insurance premiums, ongoing maintenance, and potential repairs. These costs can significantly impact your overall budget.

Based on your financial assessment, establish a total budget for buying and owning a used car. This should include both the initial purchase price and the estimated costs of ownership over the first year. Aim to strike a balance between affordability and your desired features and quality.

Keep in mind that used cars depreciate over time, meaning their value decreases as they age and accumulate mileage. Research the depreciation rates of different makes and models to anticipate future resale value and factor this into your budgeting calculations.

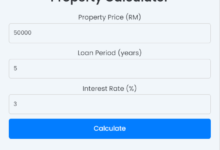

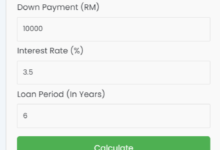

If you plan to finance the purchase with a loan, calculate a realistic monthly payment based on your budget constraints and the loan term. Use online loan calculators to estimate monthly payments based on different interest rates and down payment amounts.

It’s essential to have a financial buffer for unexpected expenses that may arise, such as repairs or medical bills. Consider setting aside a separate emergency fund or including a contingency amount in your budget to cover these unforeseen costs without impacting your ability to afford the car.

While it can be tempting to stretch your budget to afford a more expensive car or a higher trim level, be cautious not to overextend yourself financially. Aim for a budget that allows you to comfortably cover all associated costs without sacrificing other essential expenses or accruing excessive debt.

As you gather more information and explore different options, be flexible and willing to adjust your budget accordingly. You may discover unexpected costs or find a better deal than initially anticipated, requiring you to revise your budget accordingly.

By carefully assessing your finances, considering all associated costs, and setting a realistic budget, you can make informed decisions and ensure a financially sound purchase of a used car that aligns with your needs and preferences.

Full Research:

Researching different makes and models of used cars is essential to finding the right vehicle that meets your needs and preferences. Here’s how to conduct thorough research:

Start by identifying your specific requirements for a used car. Consider factors such as the size of the vehicle, fuel efficiency, performance, features, safety ratings, and budget constraints. Determine what features are must-haves and what are nice-to-haves.

Utilize online resources such as automotive websites, forums, and review platforms to gather information about various makes and models. Websites like Edmunds, Kelley Blue Book, and Consumer Reports offer comprehensive reviews, ratings, and pricing information to help you compare different vehicles.

Take the time to read reviews from owners who have firsthand experience with the cars you’re interested in. Pay attention to common complaints, reliability issues, and overall satisfaction levels to gauge the real-world performance of each model.

Look up reliability ratings from sources like Consumer Reports and J.D. Power to assess the long-term dependability of different makes and models. Vehicles with high reliability scores are generally less prone to mechanical problems and may offer better overall value.

Research the market value of used cars in your area to understand typical pricing trends and identify fair market prices for the models you’re considering. Use online pricing tools and resources like Kelley Blue Book and NADAguides to estimate the value of specific year, make, and model combinations based on factors like mileage, condition, and features.

Visit the National Highway Traffic Safety Administration (NHTSA) website to check for any recalls or safety issues related to the makes and models you’re interested in. Be wary of vehicles with unresolved recall notices, as they may pose safety risks or require costly repairs.

Participate in online forums and communities dedicated to specific car brands or models to connect with fellow enthusiasts and gather insider insights. These forums can be valuable sources of information on common issues, maintenance tips, and aftermarket modifications for different vehicles.

Look beyond the initial purchase price and consider the long-term costs of ownership, including maintenance, repairs, insurance premiums, and fuel expenses. Some makes and models may have higher maintenance costs or require specialized parts, impacting your overall budget.

Once you’ve narrowed down your options, schedule test drives with multiple vehicles to experience their performance firsthand. Pay attention to factors like driving dynamics, comfort, visibility, noise levels, and overall satisfaction during the test drive.

If you’re unsure about a particular make or model, seek advice from automotive experts, such as mechanics, car enthusiasts, or trusted professionals. They can offer valuable insights and recommendations based on their experience and expertise.

By conducting thorough research and considering various factors, you can make an informed decision when choosing a used car that aligns with your preferences, budget, and lifestyle.

Inspect the Vehicle History

Inspecting the vehicle history is a crucial step when buying a used car, as it provides valuable insights into the vehicle’s past and helps you make an informed decision. Here’s how to effectively inspect the vehicle history:

Ask the seller for the VIN, a unique 17-digit code assigned to every vehicle. You can typically find the VIN on the dashboard near the windshield, on the driver’s side door jamb, or on vehicle registration and insurance documents.

Use reputable online services like Carfax, AutoCheck, or the National Motor Vehicle Title Information System (NMVTIS) to obtain a comprehensive vehicle history report. Input the VIN into the search tool to uncover crucial information such as: Check for past collisions, damage, salvage titles, or major repairs that may indicate potential structural or safety issues.

Review the number of previous owners and the duration of ownership to gauge how well the vehicle has been maintained and cared for over time.

Verify the title status, including any liens, theft reports, or title transfers, to ensure the vehicle has a clear and legal ownership history. Look for discrepancies in mileage records to detect possible odometer tampering or rollback fraud. Access information about routine maintenance, repairs, and recalls performed on the vehicle to assess its overall condition and reliability.

Pay close attention to any red flags or warning signs indicated in the vehicle history report. Look for patterns of recurring issues, such as frequent accidents, mechanical failures, or inconsistent maintenance, that may indicate a problematic or unreliable vehicle. Compare the VIN displayed on the vehicle with the VIN listed on the title, registration documents, and insurance paperwork to ensure they match. Verify the authenticity of the documents and confirm that the seller has legal ownership of the vehicle.

Review the vehicle’s service records, maintenance receipts, and any relevant documentation provided by the seller. Look for evidence of regular maintenance, repairs, and inspections to assess the vehicle’s maintenance history and overall condition. Don’t hesitate to ask the seller about any discrepancies or concerns identified in the vehicle history report. Inquire about the vehicle’s usage, maintenance routine, accident history, and any modifications or repairs done during their ownership.

If you’re unsure about the vehicle’s condition or history, consider hiring a qualified mechanic or inspection service to conduct a thorough pre-purchase inspection. They can assess the vehicle’s mechanical, structural, and safety components to identify any hidden issues or potential problems.

Check for Red Flags?

When inspecting a used car, it’s crucial to be vigilant for any red flags that could indicate potential issues or problems with the vehicle. Here are several red flags to watch out for:

A salvage title or rebuilt title indicates that the car has been severely damaged, often due to a major accident, flood, or theft recovery. Vehicles with salvage or rebuilt titles may have undergone extensive repairs and could have hidden structural or safety issues.

Look for signs of previous accidents or collision repairs, such as mismatched paint, uneven panel gaps, visible weld marks, or ripples in the bodywork. These could indicate that the car has been involved in a crash and may have underlying structural damage.

Check for rust or corrosion on the body panels, undercarriage, and frame of the car. Excessive rust can weaken the structural integrity of the vehicle and may indicate poor maintenance or exposure to harsh environmental conditions.

Inspect the ground beneath the car for any signs of fluid leaks, such as oil, coolant, or transmission fluid. Leaks can indicate underlying mechanical problems, such as worn gaskets, seals, or hoses, which may require costly repairs.

Pay attention to any strange odors or smoke coming from the engine, exhaust system, or interior of the car. Unusual smells, such as burning oil, coolant, or mold, could indicate leaks, engine problems, or water damage.

Check the dashboard for illuminated warning lights or error messages, such as check engine light, ABS light, or airbag light. These indicators suggest potential mechanical or electrical issues that may require diagnostic testing and repairs.

Inspect the interior and exterior of the car for signs of excessive wear and tear, such as worn-out upholstery, cracked dashboard, or heavily worn tires. Excessive wear could indicate neglectful maintenance or high mileage, affecting the car’s reliability and resale value.

Verify that the seller provides complete and accurate documentation, including service records, maintenance receipts, and vehicle history reports. Be wary of sellers who are unable or unwilling to provide relevant paperwork, as it could indicate hidden issues or a lack of transparency.

Listen for any abnormal engine noises, such as knocking, grinding, or rattling, during a test drive. Excessive vibrations or rough idling could indicate engine problems or mechanical issues that require further investigation.

Pay attention to the behavior of the seller during the transaction. Be cautious of sellers who pressure you into making a quick decision, refuse to allow a pre-purchase inspection, or provide evasive answers to your questions. Trust your instincts and proceed with caution if you feel uncomfortable or suspicious.

Get a Pre-Purchase Inspection

Getting a pre-purchase inspection is a crucial step in the process of buying a used car, as it provides an unbiased assessment of the vehicle’s condition and helps uncover any hidden issues or potential problems. Here’s how to arrange and conduct a pre-purchase inspection:

Start by finding a reputable and experienced mechanic or automotive technician to perform the inspection. Look for professionals who specialize in inspecting used cars or have expertise working with the make and model you’re interested in.

Contact the mechanic or inspection service to schedule an appointment for the pre-purchase inspection. Ideally, arrange to have the inspection conducted at a neutral location, such as the mechanic’s shop or an independent inspection facility, rather than the seller’s premises.

Inform the seller that you intend to have the car inspected by a professional and coordinate a mutually convenient time for the inspection. Obtain permission to take the car to the mechanic for evaluation, or arrange for the mechanic to inspect the vehicle on-site if possible.

Ensure the car is clean, both inside and out, to facilitate a thorough inspection. Provide the mechanic with access to the keys, documentation, and any relevant information about the car’s history, maintenance records, and known issues.

The mechanic will perform a detailed examination of the vehicle, assessing various components and systems for signs of wear, damage, or malfunction. This typically includes inspecting the engine, transmission, brakes, suspension, steering, tires, electrical systems, and onboard diagnostics.

The mechanic may use diagnostic tools and equipment, such as scan tools, computer software, or specialized instruments, to assess the car’s performance, detect any error codes or warning signals, and identify potential mechanical or electrical issues.

The mechanic will document their findings and observations during the inspection, noting any identified problems, concerns, or areas of potential maintenance or repair. They may also provide recommendations for necessary repairs or maintenance tasks based on their assessment.

Once the inspection is complete, review the inspection report and discuss the findings with the mechanic. Ask for clarification on any issues or recommendations mentioned in the report and seek their professional opinion on the overall condition of the vehicle.

If the inspection reveals any significant issues or concerns, use the findings as leverage for negotiation with the seller. Request repairs, adjustments, or a price reduction to compensate for the identified issues, or consider walking away from the deal if the problems are too extensive or costly to address.

Based on the results of the pre-purchase inspection and your assessment of the vehicle’s condition and value, make an informed decision about whether to proceed with the purchase. Factor in the inspection findings, your budget, and your comfort level with the identified issues before finalizing the transaction.

Negotiate the Price

Negotiating the price is a fundamental aspect of buying a used car and can significantly impact the overall cost of the vehicle. Here’s how to effectively negotiate the price:

Before entering into negotiations, research the market value of the make, model, and year of the car you’re interested in. Use online resources such as Kelley Blue Book, Edmunds, or NADAguides to obtain pricing information based on factors like mileage, condition, and location.

Based on your research and budget constraints, establish a target price that you’re willing to pay for the used car. Consider factors such as the vehicle’s age, mileage, condition, features, and any known issues or maintenance needs.

Conduct a comprehensive inspection of the vehicle to identify any issues or concerns that may impact its value. Note any repairs or maintenance tasks that may be necessary and factor these into your negotiation strategy.

Use the inspection findings, market research, and any other relevant information to identify potential points of negotiation. This could include addressing known issues, requesting repairs or maintenance, or highlighting comparable listings with lower prices.

Initiate negotiations with a reasonable and competitive offer based on your research and assessment of the vehicle’s value. Present your offer to the seller confidently but respectfully, leaving room for counteroffers and further discussion.

Emphasize the positive aspects of the car and your genuine interest in making a fair deal. Acknowledge any desirable features or unique selling points that may justify the asking price while still advocating for a lower offer based on market trends and condition.

Be prepared to walk away from the negotiation if the seller is unwilling to meet your target price or address your concerns. Demonstrating your willingness to walk away can sometimes prompt the seller to reconsider their position and make concessions to close the deal.

In addition to the purchase price, consider negotiating other terms of the sale, such as the inclusion of additional accessories or services, extended warranties, financing options, or trade-in allowances. Look for opportunities to enhance the overall value of the deal beyond just the price.

Be flexible and open to compromise during the negotiation process. Consider alternative solutions or concessions that may satisfy both parties and lead to a mutually beneficial agreement. Remember that successful negotiation often involves give-and-take from both sides.

Once you’ve reached a satisfactory agreement, ensure that all terms and conditions are documented in writing, including the final purchase price, any agreed-upon repairs or adjustments, and any other relevant details. Review the written agreement carefully before signing to avoid misunderstandings or disputes later on.

Consider Certified Pre-Owned (CPO) Vehicles?

Considering certified pre-owned (CPO) vehicles is a smart option when buying a used car, as they offer additional peace of mind and assurance of quality. Here are some reasons to consider CPO vehicles:

CPO vehicles undergo a rigorous inspection and certification process mandated by the manufacturer or dealership. These inspections typically cover hundreds of points, ensuring that the vehicle meets high standards of quality, safety, and reliability.

CPO vehicles often come with extended warranty coverage beyond the original factory warranty. This additional protection can provide reassurance against unexpected repair costs and offer peace of mind during ownership.

CPO programs are typically backed by the vehicle manufacturer or authorized dealership, providing access to manufacturer-trained technicians, genuine parts, and specialized service facilities. This ensures that any necessary repairs or maintenance are performed to factory standards.

CPO vehicles come with a comprehensive vehicle history report, detailing the car’s maintenance history, ownership records, and any reported accidents or damage. This transparency allows buyers to make informed decisions and ensures full disclosure of the vehicle’s past.

Many CPO programs include additional benefits such as roadside assistance, trip interruption coverage, complimentary maintenance services, and vehicle exchange policies. These perks enhance the ownership experience and provide added value to buyers.

CPO vehicles typically retain higher resale values compared to non-certified used cars due to their enhanced condition, warranty coverage, and perceived reliability. This can result in lower depreciation costs over time and potentially higher trade-in values when it’s time to sell or upgrade.

Perhaps the most significant advantage of buying a CPO vehicle is the peace of mind it offers. Knowing that the car has been thoroughly inspected, certified, and backed by the manufacturer can instill confidence and reduce the risk of unexpected issues or problems down the road.

Review Financing Options

Reviewing financing options is an important step in the process of buying a used car, as it allows you to secure the necessary funds to make the purchase. Here’s how to effectively review your financing options:

Start by checking your credit score, as it will play a significant role in determining the interest rates and loan terms you qualify for. You can obtain a free copy of your credit report from major credit bureaus like Equifax, Experian, or TransUnion. A higher credit score typically results in lower interest rates and more favorable loan terms.

Based on your financial situation and credit score, determine how much you can afford to borrow and repay each month. Consider factors such as your income, expenses, existing debt obligations, and the total cost of owning the car (including insurance, maintenance, and fuel).

Research and compare financing options from various sources, including banks, credit unions, online lenders, and dealership financing. Obtain quotes from multiple lenders to compare interest rates, loan terms, fees, and repayment options. Look for lenders that offer competitive rates and flexible terms that align with your budget and needs.

Consider getting pre-approved for a car loan before shopping for a used car. Pre-approval involves submitting a loan application and providing financial documentation to a lender, who then determines the loan amount, interest rate, and terms you qualify for. Pre-approval can streamline the car-buying process and give you negotiating power with sellers.

When reviewing loan offers, don’t hesitate to negotiate interest rates and loan terms with the lender. If you have a strong credit score or a history of timely payments, you may be able to secure lower interest rates or more favorable terms. Use competing offers from other lenders as leverage to negotiate better terms.

Understand Additional Fees and Charges: In addition to the interest rate, be aware of any additional fees or charges associated with the loan, such as origination fees, prepayment penalties, or documentation fees. Factor these costs into your overall budget and compare them across different loan offers to ensure you’re getting the best deal.

Some lenders and financial institutions offer special financing programs for used car buyers, such as promotional interest rates, cash rebates, or incentives for first-time buyers or military members. Review these programs carefully to see if you qualify for any additional benefits or discounts.

Before finalizing the loan agreement, carefully review all terms and conditions outlined in the loan contract, including the repayment schedule, interest rate, loan duration, and any additional provisions or disclosures. Make sure you understand the terms fully and ask questions about anything you’re unsure about.

Determine whether you’ll be making a down payment or trading in a vehicle to reduce the amount you need to finance. A larger down payment can lower your monthly payments and interest costs, while a trade-in can offset the purchase price of the new car.

If you’re unsure about which financing option is best for you, consider seeking advice from financial advisors or experts who can provide personalized recommendations based on your financial goals and circumstances. They can help you navigate the loan process and make informed decisions that align with your long-term financial plans.

Understand Ownership Costs

Understanding ownership costs is essential when buying a used car, as it allows you to budget effectively and plan for the ongoing expenses associated with vehicle ownership. Here’s how to understand and calculate ownership costs:

The initial purchase price of the used car is the most significant upfront cost. This includes the negotiated price of the vehicle, any taxes or fees, and additional expenses such as registration and licensing fees.

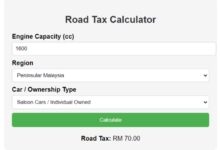

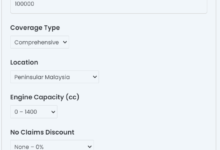

Factor in the cost of insurance premiums when budgeting for ownership costs. Insurance rates vary based on factors such as the vehicle’s make and model, age, mileage, your driving history, and location. Obtain insurance quotes from multiple providers to compare rates and coverage options.

Estimate the cost of fuel based on the vehicle’s fuel efficiency (miles per gallon) and your typical driving habits. Consider factors such as gas prices, your daily commute, and any long-distance trips you plan to take. Use online fuel cost calculators to determine your monthly or annual fuel expenses.

Budget for routine maintenance tasks such as oil changes, tire rotations, brake inspections, and fluid replacements. Additionally, set aside funds for unexpected repairs or mechanical issues that may arise over time. Consider the age, mileage, and condition of the car when estimating maintenance and repair costs.

Plan for the cost of replacing tires as they wear out over time. Check the condition of the tires on the used car and research the cost of replacement tires for the specific make and model. Factor in the frequency of tire replacements based on driving conditions and mileage.

Understand that used cars depreciate over time, meaning their value decreases as they age and accumulate mileage. Consider the anticipated depreciation rate of the vehicle and its impact on the car’s resale value when budgeting for ownership costs. Research depreciation rates for similar makes and models to estimate future resale value.

Account for ongoing taxes, such as property taxes or vehicle registration fees, associated with owning the car. These costs may vary depending on your location and local regulations.

Consider any optional add-ons or accessories you may want to purchase for the vehicle, such as extended warranties, aftermarket upgrades, or maintenance plans. Evaluate the cost-effectiveness of these add-ons and include them in your overall ownership budget if necessary.

Factor in the cost of parking fees, tolls, and other transportation-related expenses associated with owning and operating the vehicle. Consider your typical driving patterns and parking arrangements when estimating these costs.

Calculate the total cost of ownership by adding up all the aforementioned expenses over the expected lifespan of the vehicle. This will give you a comprehensive understanding of the ongoing costs associated with owning the used car and help you budget effectively for the long term.

Complete the Paperwork Properly?

Completing the paperwork properly is a critical step in the process of buying a used car, as it ensures that the transaction is legally binding and properly documented. Here’s how to complete the paperwork effectively:

The bill of sale is a legal document that records the details of the sale transaction, including the purchase price, vehicle identification information (make, model, VIN), buyer and seller information, and the date of sale. Ensure that the bill of sale is accurately completed and signed by both parties.

The title is a legal document that establishes ownership of the vehicle. When buying a used car, ensure that the seller provides a clear and valid title with their name listed as the owner. Complete the title transfer process according to the requirements of your state or jurisdiction, including signing the title, obtaining a release of lien if applicable, and submitting the necessary paperwork to the appropriate authorities.

Register the vehicle in your name with the relevant state or local authorities to legally drive it on public roads. Obtain the necessary registration documents, such as a certificate of title, vehicle registration application, proof of insurance, and emissions or safety inspection certificates, and submit them to the appropriate agency or department.

Pay any applicable sales tax on the purchase of the used car according to the laws and regulations of your state or jurisdiction. Obtain a receipt or proof of payment for the sales tax and include it in your records for future reference.

Review any warranty or disclosure documents provided by the seller, including manufacturer warranties, extended warranties, or dealer warranties. Ensure that you understand the terms and coverage of any warranties offered and retain copies of the documents for your records.

If you’re financing the purchase of the used car with a loan, review and sign the loan documents provided by the lender. This may include a loan agreement, promissory note, security agreement, and any other related paperwork. Understand the terms and conditions of the loan, including the interest rate, loan duration, and repayment schedule.

Obtain a release of liability form from the seller to transfer responsibility for the vehicle to you as the new owner. This document notifies the relevant authorities that you are now the legal owner of the car and releases the seller from any liability or responsibility associated with the vehicle after the sale.

Keep copies of all completed paperwork, receipts, and documents related to the purchase of the used car for your records. This includes the bill of sale, title transfer documents, registration paperwork, sales tax receipts, warranty documents, and any loan agreements or financing paperwork. Store these documents in a safe and accessible location for future reference or documentation purposes.

Double-check all information and details on the paperwork to ensure accuracy and completeness. Verify the VIN, vehicle description, purchase price, buyer and seller information, and any other relevant details before signing the documents.

If you’re unsure about any aspect of the paperwork or legal requirements associated with buying a used car, consider seeking assistance from a legal professional or vehicle registration expert. They can provide guidance, review documents, and ensure that the transaction is completed properly and in compliance with applicable laws and regulations.

Final Word: By following these tips and taking a systematic approach, you can confidently navigate the process of buying a used car and find a reliable vehicle that meets your needs and budget.