Car Loan Calculator in Malaysia

Learn whether owning your dream car is a possibility, using the car loan calculator we made especially for you.

Car Loan Calculator

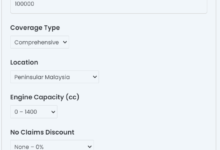

Also Visit : Car Insurance Calculator

A car loan calculator in Malaysia is a tool that is primarily designed to give an estimate of monthly payments and overall costs of the loan to the interested party. It executes input variables such as the loan amount, the loan term (the loan’s duration), the rate of interest on the loan, and any conditional charges or administrative taxes into equations and then very meticulously displays the reply for the input data. Through the provided variables, they can figure out what amount they have to pay monthly and the amount they will totally pay back over the lifespan of the loan.

How it work Loan Calculator

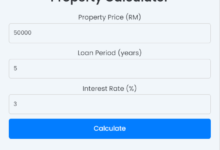

A car loan calculator is an online tool computing the monthly payments, total interest paid, and total price of the loan. All this is the result of a complicated mathematical formula that the user cannot see, it is already put into the system and the user merely writes the data, and operates the calculator. Below in the box is a step by step breakdown of the entire process:

Input Parameters: The user inserts the specific data for the loan amount (e.g. the total amount borrowed for the car), the interest rate which is an annual percentage rate that the lender charges; the loan period which is the time over which the repayment is done, usually in years; and any additional, all with your discretion, including the down payment, if any.

Calculation: After these parameters are found by the user, the car loan calculator then follows some algorithms to come up with, for the most part, the final outputs, the formula for these calculations is pretty much easily manipulated in the sense of equation solving. Some of the main computations include:

Monthly Payment: The borrower must disclose the loan amount, the annual rate of interest, and the terms. The payments will be on a monthly basis.

Total Interest Paid: This is normally done by multiplying the monthly payment by the total number of payments and then subtracting the total loan amount that you arrive at in order to get the total interest out of the loan.

After the calculations are done, the car loan calculator displays the results to the user. This mostly happens to show the value of the monthly payments, the interest that is being paid, and the total cost of the loan including the interest.

Optional Car loan calculators might have some improved functions like the inclusion of taxes and fees, modifying the loan term, or interest rate, and comparison of various loan options.

Benefits Of Using This Calculator

A car loan calculator offers more than one benefit for individuals who want to finance a vehicle:

The calculator is the first step to loan planning as it offers a model of financing your car through a reasonable monthly payment. For this, you can get the monthly amounts for each one of the following: for a given loan amount, annual interest, and the debt period. This way, you can see the maximum you can borrow and the exact amount that you need to set aside to pay it.

By comparison of the various car loan options, you would have the chance to make your loan a means of getting the best deal. You will gain access to the provider that offers the most favorable terms and save money throughout the entire credit period.

Budgeting Tool: It is a great tool for budgeting because it gives a clear picture of your monthly car loan payment among other expenses. In this way, you can review your budget and being sure that you can accommodate the loan without moving your finances to the edge.

The presence of the calculating machine is very critical as it supports you in the decision-making process on the type of car you can buy and the funding options that are at your disposal. It gives you the power to make a decision that is in line with your goals and the financial situation you are in.

Visualization: Many car loan calculators use diagrams, such as the amortization schedule, to show the allocation of your payments over time. A graphical view like this can help you to see the principal and interest payments and their variations over the life of the loan.

Your question car loan calculator work?

Which question will you have about this calculator? Let’s justify these. There we are including the major questions and answers about this tools. So, let’s start now.

A car loan calculator estimates your monthly payments based on variables like loan amount, interest rate, and loan term.

While it provides a close estimate, actual payments may vary based on factors like taxes, fees, and credit score.

Yes, car loan calculators are versatile and can be used for various types of vehicles, including cars, trucks, and SUVs.

Yes, it’s essential to factor in additional expenses like insurance, maintenance, and fuel costs when budgeting for a car.

Absolutely. By adjusting the loan term in the calculator, you can see how it impacts your monthly payments and overall loan cost.

No, most car loan calculators are free to use and readily available online.

No, anyone can use a car loan calculator regardless of their credit score.