Etiqa Car Insurance: Comprehensive Coverage For Private Cars

Etiqa offers comprehensive car insurance coverage for private cars in Malaysia, catering to the specific needs of drivers in the country. With a commitment to providing reliable protection and peace of mind, Etiqa’s car insurance policies encompass various features to ensure comprehensive coverage.

Key Features of Etiqa Car Insurance:

- Full Body Coverage: Etiqa understands the importance of safeguarding your vehicle against unforeseen events. Their comprehensive coverage includes protection for the entire body of your private car, ensuring that damages are addressed comprehensively.

- Customized Policies: Etiqa tailors insurance policies to meet the unique requirements of drivers in Malaysia. Whether you are concerned about accidents, theft, or natural disasters, Etiqa provides options to suit your specific needs.

- 24/7 Roadside Assistance: Etiqa goes beyond standard coverage by offering 24/7 roadside assistance. This service ensures that you receive prompt support in case of breakdowns, accidents, or other emergencies, adding an extra layer of protection to your driving experience.

- Targeted Coverage for Malaysia: Etiqa’s car insurance is designed with the Malaysian landscape in mind. It takes into account the specific challenges and risks faced by drivers in the country, providing coverage that aligns with local conditions.

- FAQs for Clarity: To enhance customer understanding, Etiqa consistently generates frequently asked questions (FAQs) about their car insurance policies. These FAQs serve as a valuable resource, offering clarity on coverage details, claim processes, and other pertinent information.

- Online Convenience: Etiqa leverages technology to offer an easy and convenient online experience. From obtaining quotes to filing claims, the digital platform simplifies the insurance process, making it accessible for customers across Malaysia.

- Financial Security: Etiqa’s reputation as a reliable insurance provider adds an additional layer of confidence. Knowing that your car is backed by a financially secure company provides peace of mind, assuring you that claims will be handled efficiently.

Etiqa‘s comprehensive car insurance for private cars in Malaysia goes beyond the basics, offering full-body coverage, tailored policies, and additional benefits like 24/7 roadside assistance. With a commitment to customer clarity, they consistently generate FAQs to address common queries and ensure that policyholders are well-informed. Choose Etiqa for a reliable and customized car insurance experience tailored to the Malaysian market.

Key benefits for car owners:

For car owners, Etiqa’s comprehensive car insurance offers several key benefits:

- Financial Protection: Comprehensive coverage protects your vehicle against a wide range of risks, including accidents, theft, vandalism, fire, and natural disasters. This provides financial security by covering repair or replacement costs in case of damage or loss.

- Third-Party Liability Coverage: Protection against legal liabilities to third parties for bodily injury, death, or property damage caused by your vehicle in an accident. This coverage ensures that you are financially protected against potential lawsuits and compensation claims.

- Personal Accident Coverage: Some policies may include personal accident coverage for the driver and passengers, offering financial compensation for medical expenses, disability, or death resulting from a car accident.

- Peace of Mind: Knowing that your vehicle is adequately insured provides peace of mind, allowing you to drive with confidence and focus on the road without worrying about potential financial burdens in case of unforeseen incidents.

- Convenience: Etiqa’s comprehensive car insurance typically includes additional services such as 24/7 roadside assistance, towing assistance, and windscreen coverage, offering convenience and support in case of emergencies or breakdowns.

- No-Claim Discount (NCD): Safe drivers are rewarded with a No-Claim Discount (NCD), which reduces the renewal premiums for every claim-free year. This incentivizes safe driving behavior and helps car owners save money on insurance premiums over time.

Overall, Etiqa’s comprehensive car insurance provides car owners with financial protection, peace of mind, and added convenience, along with incentives for safe driving. It’s essential to review the policy details, coverage limits, and exclusions to ensure that the insurance meets your specific needs and preferences as a car owner.

Add-on coverage:

In addition to the standard coverage provided in Etiqa’s comprehensive car insurance policies, car owners have the option to enhance their coverage by selecting add-on coverage or optional extras tailored to their specific needs. Some common add-on coverages offered by Etiqa may include:

- Special Perils Extension: Extends coverage to include additional perils such as flood, landslide, and other natural disasters not typically covered under standard comprehensive policies.

- Enhanced Roadside Assistance: Offers expanded roadside assistance services such as accommodation arrangements, emergency messaging services, or concierge services.

- No-Claim Protection: Protects your No-Claim Discount (NCD) in case of an accident, allowing you to maintain your discount even after making a claim.

- Additional Windscreen Coverage: Increases coverage limits for repair or replacement of damaged windscreens and windows, providing greater peace of mind.

- Loss of Use Coverage: Provides reimbursement for alternative transportation expenses while your vehicle is undergoing repairs following an insured accident.

- Key Replacement Coverage: Covers the cost of replacing lost or stolen keys, including locksmith services and replacement key fobs.

- Waiver of Betterment: Waives the betterment charges that may apply when replacing damaged parts with new ones during repairs, ensuring that you are not responsible for additional costs due to depreciation.

- Personal Accident Coverage Extension: Increases coverage limits or adds coverage for specific scenarios such as medical expenses, disability benefits, or funeral expenses resulting from a car accident.

These add-on coverages allow car owners to customize their insurance policies according to their individual requirements, providing enhanced protection and peace of mind on the road. It’s essential to carefully review the available add-ons, their costs, and the terms and conditions to determine which ones are most suitable for your needs.

(Frequently Asked Questions) about Etiqa Car Insurance

Etiqa’s comprehensive car insurance typically covers damages to your own vehicle (own damage), third-party liabilities, personal accident coverage, legal liability to passengers, windscreen coverage, towing assistance, roadside assistance, and more.

You can purchase Etiqa car insurance directly from their website, through authorized agents, or by visiting Etiqa branches. You can also contact their customer service for assistance with purchasing or renewing your policy.

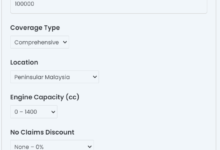

Premiums for Etiqa car insurance are typically determined based on factors such as the make and model of your vehicle, its age, your age and driving experience, your claims history, the coverage options selected, and any add-on coverages chosen.

Yes, Etiqa offers online renewal services for car insurance policies through their website. You can log in to your account, review your policy details, and renew your insurance conveniently online.

In case of an accident, you should immediately report the incident to Etiqa’s claims hotline and provide necessary details such as the location, time, and nature of the accident. Follow the instructions provided by Etiqa for claims processing and assistance.

Yes, Etiqa offers discounts such as the No-Claim Discount (NCD) for every claim-free year, rewarding safe driving behavior. They may also offer other discounts or promotions from time to time, which you can inquire about when purchasing or renewing your policy.

Yes, Etiqa allows you to customize your car insurance policy by selecting optional add-on coverages to enhance your protection according to your specific needs. You can choose from a range of add-ons such as special perils extension, enhanced roadside assistance, loss of use coverage, and more.

Etiqa car insurance offers comprehensive coverage, flexible options, and excellent customer service to ensure that you have peace of mind on the road. Whether you’re looking for basic coverage or want to enhance your protection with optional add-ons, Etiqa strives to meet your needs and provide reliable support whenever you need it. With Etiqa, you can drive confidently knowing that you’re well-protected by one of Malaysia’s leading insurance providers.