A Comprehensive Guide to Buying a Car in Malaysia: Tips and Insights

Purchasing a car is a significant milestone that comes with its own set of considerations, particularly in a diverse and dynamic market like Malaysia. Whether you’re a first-time buyer or looking to upgrade your vehicle, this guide aims to provide valuable insights and practical tips to navigate the process of buying a car in Malaysia seamlessly.

Key Considerations When Buying a Car in Malaysia?

When buying a car in Malaysia, several key considerations should be taken into account to ensure you make an informed decision:

- Budget: Determine your budget for purchasing a car, including the down payment, monthly installments (if applicable), insurance, road tax, and maintenance costs.

- Car Type: Decide on the type of car that suits your needs, whether it’s a sedan, hatchback, SUV, MPV, or hybrid. Consider factors such as fuel efficiency, seating capacity, and cargo space.

- Fuel Efficiency: With rising fuel prices, it’s essential to consider the car’s fuel efficiency. Opt for vehicles with good mileage to save on fuel costs in the long run.

- Resale Value: Research the resale value of different car models to ensure you choose one that holds its value well over time. Popular brands and models tend to have better resale values.

- Ownership Costs: Consider the overall ownership costs, including insurance premiums, road tax, maintenance, and servicing expenses. Some cars may have higher maintenance costs due to parts availability and service charges.

- Safety Features: Prioritize safety features such as airbags, ABS brakes, stability control, and collision avoidance systems. Check the car’s safety ratings from reliable sources like ASEAN NCAP.

- Reliability and Durability: Look for car brands known for their reliability and durability. Research customer reviews, reliability ratings, and manufacturer warranties to gauge the car’s quality.

- Brand Reputation and Dealer Network: Choose a reputable car brand with a strong dealer network and reliable after-sales service. This ensures easy access to spare parts, servicing, and repairs.

- Test Drive: Always test drive the car before making a purchase to assess its comfort, driving dynamics, and overall performance. Pay attention to noise levels, ride quality, handling, and visibility.

- Financing Options: Explore different financing options such as car loans, hire purchase, or leasing to find the most suitable arrangement with favorable interest rates and repayment terms.

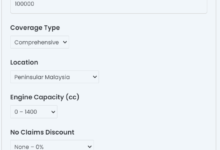

- Insurance Coverage: Compare insurance quotes from different providers to find the best coverage at competitive rates. Consider additional coverage options like comprehensive insurance and windshield protection.

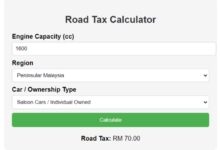

- Road Tax and Registration Fees: Understand the road tax and registration fees associated with owning a car in Malaysia. These costs vary depending on the vehicle’s engine capacity and type.

- Environmental Impact: Consider the environmental impact of the vehicle, including its emissions and fuel consumption. Opt for eco-friendly options such as hybrid or electric vehicles if possible.

- Special Requirements: If you have specific needs or preferences, such as wheelchair accessibility or child seat compatibility, ensure the chosen car meets those requirements.

- Resale Market Trends: Research current market trends and predictions for the resale value and demand of different car models to make a more informed decision on your purchase.

By considering these factors carefully, you can choose a car that not only fits your budget and lifestyle but also provides safety, reliability, and long-term satisfaction.

Budget Planning:

Budget planning for buying a car involves several steps to ensure you can afford the purchase and associated expenses. Here’s a comprehensive guide to help you plan your budget effectively:

- Determine Affordability: Assess your financial situation to determine how much you can afford to spend on a car. Consider your income, expenses, savings, and other financial obligations.

- Establish a Budget: Set a realistic budget for the total cost of the car, including the down payment, monthly installments (if financing), insurance, road tax, maintenance, and fuel expenses.

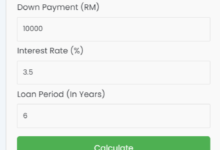

- Down Payment: Decide on the amount you can comfortably put down as a down payment. A larger down payment reduces the loan amount and lowers your monthly installments.

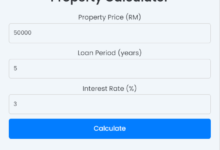

- Monthly Installments: Calculate your monthly installment payments based on different loan terms, interest rates, and down payment amounts. Choose a repayment plan that fits within your budget.

- Loan Options: Explore different financing options such as car loans, hire purchase, or leasing. Compare interest rates, repayment terms, and eligibility criteria to find the most suitable option.

- Insurance Costs: Research insurance premiums for the car you’re considering purchasing. Factor in comprehensive coverage, third-party coverage, and additional options like windshield protection.

- Road Tax and Registration Fees: Estimate the road tax and registration fees based on the vehicle’s engine capacity and type. These costs vary depending on the state or region in Malaysia.

- Maintenance and Servicing: Budget for ongoing maintenance and servicing expenses, including regular oil changes, tire replacements, brake servicing, and other repairs.

- Fuel Expenses: Estimate your monthly fuel expenses based on the car’s fuel efficiency and your typical driving habits. Consider rising fuel prices and plan accordingly.

- Emergency Fund: Set aside an emergency fund to cover unexpected expenses such as repairs, accidents, or job loss. Aim to have at least three to six months’ worth of living expenses saved up.

- Trade-In or Resale Value: If you’re trading in a car or planning to sell your current vehicle, factor in the trade-in value or resale value to offset the cost of the new car.

- Additional Costs: Be prepared for additional costs such as parking fees, tolls, and accessories like car mats, seat covers, or security systems.

- Review and Adjust: Regularly review your budget and make adjustments as needed based on changes in your financial situation or expenses.

- Consider Long-Term Costs: Think about the long-term costs of owning a car, including depreciation, interest payments, and opportunity costs. Choose a car that fits your budget not only in the short term but also over the long term.

- Seek Professional Advice: If you’re unsure about budget planning or financing options, consider seeking advice from a financial advisor or car finance specialist.

By carefully planning your budget and considering all associated expenses, you can make a more informed decision when buying a car and ensure you can afford it without compromising your financial stability.

Understanding Car Models

Understanding car models involves familiarizing yourself with various aspects of each model, including its classification, features, performance, and target market. Here’s a breakdown of key factors to consider when understanding car models:

- Classification: Cars are classified into different categories based on body style, size, and purpose. Common classifications include sedans, hatchbacks, SUVs (sport utility vehicles), crossovers, coupes, convertibles, wagons, and trucks.

- Body Style: Each car model has a distinct body style that affects its appearance, functionality, and practicality. Body styles range from traditional sedans with four doors and a trunk to versatile SUVs with spacious interiors and elevated ride heights.

- Features: Car models come with a range of features, including technology, safety, comfort, and convenience features. Examples include infotainment systems, navigation systems, adaptive cruise control, lane departure warning, leather upholstery, panoramic sunroofs, and power-operated seats.

- Performance: Consider the performance characteristics of each car model, including engine power, acceleration, fuel efficiency, handling, and ride comfort. Performance-oriented models may prioritize speed and agility, while others focus on fuel economy and comfort.

- Engine Options: Car models often offer multiple engine options to cater to different preferences and driving needs. Engine options vary in terms of displacement, power output, fuel type (gasoline, diesel, hybrid, electric), and transmission type (manual, automatic, CVT).

- Trim Levels: Car models typically come in different trim levels or variants, each offering varying levels of equipment and features. Trim levels may include base models, mid-level trims, and top-tier variants with premium amenities and upgrades.

- Target Market: Car manufacturers design each model with a specific target market in mind, considering factors such as demographics, lifestyle, preferences, and purchasing power. Some models may target families, commuters, outdoor enthusiasts, performance enthusiasts, or luxury buyers.

- Price Range: Car models vary in price range depending on factors such as brand reputation, features, technology, performance, and exclusivity. Entry-level models tend to be more affordable, while premium and luxury models command higher prices.

- Brand Reputation: Consider the reputation of the car manufacturer and the reliability of the model when evaluating different car models. Established brands with a track record of quality and durability may offer greater peace of mind to buyers.

- Reviews and Ratings: Research professional reviews, owner feedback, and reliability ratings to gauge the strengths and weaknesses of each car model. Pay attention to factors such as build quality, driving experience, ownership costs, and resale value.

- Test Drive: Schedule test drives of different car models to experience firsthand their performance, handling, comfort, and features. Test driving multiple models allows you to compare and determine which one best suits your preferences and needs.

By understanding these aspects of car models, you can make a more informed decision when selecting a vehicle that aligns with your lifestyle, preferences, and budget.

New vs. Used Cars

When deciding between purchasing a new or used car, several factors should be considered to determine which option is best suited to your needs, preferences, and budget. Here’s a comparison of the advantages and disadvantages of buying new and used cars:

New Cars:

Advantages:

- Warranty Coverage: New cars typically come with manufacturer warranties that cover repairs and maintenance for a certain period, providing peace of mind against unexpected expenses.

- Latest Features: New cars often feature the latest technology, safety features, and advancements in performance, comfort, and convenience.

- Customization Options: Buyers can customize new cars according to their preferences, choosing colors, trims, and optional features to create a personalized vehicle.

- Reliability: New cars have not been subjected to wear and tear, so they are less likely to have mechanical issues or require immediate repairs.

- Financing Options: Manufacturers and dealers may offer attractive financing deals, such as low-interest rates or cash rebates, to incentivize new car purchases.

Disadvantages:

- Higher Depreciation: New cars experience rapid depreciation in value during the first few years of ownership, losing a significant portion of their initial value.

- Higher Purchase Price: New cars are more expensive upfront compared to used cars, requiring larger down payments and higher monthly payments for financing.

- Limited Selection: The availability of specific models, colors, and features may be limited for new cars, especially if demand is high or supply is constrained.

- Higher Insurance Costs: New cars typically have higher insurance premiums due to their higher value and repair costs.

- Potential for Hidden Issues: Despite being new, some cars may still have manufacturing defects or quality issues that only become apparent after purchase.

Used Cars:

Advantages:

- Lower Purchase Price: Used cars are generally more affordable than new cars, allowing buyers to get more value for their money and potentially afford a higher-end model or trim level.

- Reduced Depreciation: Used cars have already experienced the majority of their depreciation, so they retain their value more effectively compared to new cars.

- More Options: The used car market offers a wider selection of makes, models, trims, and price ranges, providing buyers with greater flexibility and choice.

- Lower Insurance Costs: Used cars typically have lower insurance premiums than new cars due to their lower value and repair costs.

- Vehicle History Reports: Buyers can access vehicle history reports to review the car’s maintenance records, accident history, and ownership details, helping them make informed purchasing decisions.

Disadvantages:

- Limited Warranty Coverage: Used cars may have limited or no warranty coverage, leaving buyers responsible for repairs and maintenance costs.

- Uncertain Condition: Used cars may have wear and tear, mechanical issues, or hidden problems that require immediate attention or costly repairs.

- Outdated Features: Older used cars may lack the latest technology, safety features, and amenities found in newer models.

- Higher Financing Costs: Interest rates for used car loans may be higher than those for new car loans, resulting in higher overall financing costs.

- Risk of Buying from Unreliable Sellers: Purchasing a used car from a private seller or less reputable dealership carries a higher risk of encountering dishonest sellers or purchasing a vehicle with undisclosed issues.

Ultimately, the decision between buying a new or used car depends on your individual preferences, budget, and priorities. Consider factors such as depreciation, warranty coverage, features, reliability, and overall value to determine which option best meets your needs and financial circumstances.

Financing Options

When it comes to financing a car purchase, several options are available to buyers, each with its own advantages and considerations. Here are the most common financing options for purchasing a car:

- Car Loans: Car loans are the most traditional way to finance a car purchase. With a car loan, you borrow a specific amount of money from a lender (such as a bank, credit union, or online lender) to purchase the car. You then repay the loan amount plus interest over a set period, typically ranging from three to seven years. Car loans offer fixed or variable interest rates and may require a down payment, depending on the lender and your creditworthiness.

- Hire Purchase (HP): Hire purchase is a type of installment financing where you hire the car from the lender until you’ve paid off the full purchase price, including interest. You make regular monthly payments over an agreed-upon term, typically ranging from one to five years. Once you’ve made all the payments, you own the car outright. Hire purchase is often offered by dealerships and may require a down payment.

- Personal Loans: Personal loans can be used to finance a car purchase and offer flexibility in terms of repayment. With a personal loan, you borrow a lump sum of money from a bank, credit union, or online lender and repay it over a fixed term, typically ranging from one to seven years. Personal loans may have fixed or variable interest rates and can be used to purchase new or used cars. They may not require collateral but may have higher interest rates compared to car loans.

- Leasing: Leasing involves renting a car from a dealership or leasing company for a set period, usually two to four years. You make monthly lease payments based on the car’s depreciation during the lease term, along with finance charges and fees. At the end of the lease term, you return the car to the leasing company. Leasing typically requires a lower upfront cost compared to buying, but you don’t own the car at the end of the lease unless you choose to buy it outright.

- Balloon Financing: Balloon financing, also known as balloon payments or residual value financing, involves making lower monthly payments throughout the loan term with a larger “balloon” payment due at the end of the term to pay off the remaining balance. Balloon financing can help lower monthly payments but may result in higher overall costs due to the larger final payment.

When considering financing options for a car purchase, it’s essential to compare interest rates, loan terms, down payment requirements, fees, and total costs over the life of the loan. Additionally, consider your financial situation, credit score, and preferences to choose the financing option that best suits your needs and budget. It’s also advisable to shop around and negotiate with multiple lenders or dealerships to secure the most favorable terms and conditions.

Tips for a Smooth Car Buying Experience

A smooth car buying experience involves thorough preparation, research, and effective negotiation. Here are some tips to help ensure a smooth and successful car buying process:

- Set a Budget: Determine your budget for the car purchase, including down payment, monthly payments, insurance, taxes, and other associated costs. Stick to your budget to avoid overspending.

- Research: Research different car models, features, prices, and dealerships online before visiting any dealerships. Compare prices, read reviews, and gather information to make informed decisions.

- Pre-Approval: Get pre-approved for a car loan from your bank or credit union before visiting dealerships. Pre-approval gives you a better understanding of your budget and negotiating power.

- Test Drive: Schedule test drives for the car models you’re interested in to evaluate their performance, comfort, and features. Take your time during the test drive and ask questions about the car’s specifications and options.

- Negotiate: Negotiate the price of the car with the dealership to get the best possible deal. Research the fair market value of the car and use this information to negotiate a lower price or additional incentives.

- Consider Used Cars: Explore both new and used car options to find the best value for your budget. Used cars can offer significant savings while still providing reliable transportation.

- Inspect the Car: Thoroughly inspect the car’s exterior, interior, and mechanical components before making a purchase. Look for any signs of damage, wear and tear, or issues that may affect the car’s performance.

- Check Vehicle History: Obtain a vehicle history report for used cars to check for any accidents, damages, or other issues. A clean vehicle history report indicates that the car has been well-maintained and has no major issues.

- Review Financing Terms: Carefully review the financing terms, including interest rates, loan terms, down payment requirements, and monthly payments. Make sure you understand all the terms and conditions before signing any paperwork.

- Finalize the Deal: Once you’re satisfied with the price and terms, finalize the deal with the dealership. Review and sign all the necessary paperwork, including the sales contract, loan agreement, and any additional documents.

- Arrange Insurance: Arrange insurance coverage for your new car before driving it off the lot. Shop around for the best insurance rates and coverage options that fit your needs and budget.

- Take Delivery: Take delivery of your new car and ensure that all paperwork, keys, and accessories are provided as agreed upon. Familiarize yourself with the car’s features and operation before driving it home.

- Follow-Up: Follow up with the dealership after the purchase to address any questions, concerns, or issues that may arise. Keep records of all transactions and documents related to the car purchase for future reference.

By following these tips, you can navigate the car buying process smoothly and confidently, ensuring that you get the best possible deal on the car that meets your needs and budget.

Test Drives and Inspections

Test drives and inspections are crucial steps in the car buying process to ensure that you’re making an informed decision and purchasing a reliable vehicle. Here are some tips for conducting effective test drives and inspections:

Test Drives:

- Schedule Appointments: Contact the dealership or seller in advance to schedule test drives for the cars you’re interested in. This ensures that the vehicles are available and prepared for your evaluation.

- Plan Routes: Choose a variety of routes for your test drives, including city streets, highways, and rural roads. Test different driving conditions to assess the car’s performance, handling, and comfort.

- Check Comfort and Ergonomics: Pay attention to the comfort of the seats, visibility, and ease of access to controls and features. Ensure that the driving position feels comfortable and that you have adequate legroom and headroom.

- Test Features: Test the car’s features, including the infotainment system, climate control, navigation, and safety features. Familiarize yourself with how they work and ensure they meet your expectations.

- Listen for Noises: Listen for any unusual noises or vibrations during the test drive, such as engine rattles, squeaks, or thumps. These may indicate underlying mechanical issues that require further inspection.

- Evaluate Performance: Assess the car’s acceleration, braking, and handling to ensure it meets your driving preferences and expectations. Test the car’s maneuverability in parking lots and tight spaces.

- Note Driving Dynamics: Pay attention to the car’s ride quality, steering responsiveness, and overall driving dynamics. A smooth and comfortable ride is essential for long-term satisfaction.

- Take Your Time: Don’t rush through the test drive. Take your time to thoroughly evaluate each car and ask questions about any concerns or observations you have.

Inspections:

- Visual Inspection: Inspect the car’s exterior for signs of damage, rust, or paint imperfections. Check for uniform panel gaps and alignment to ensure the car hasn’t been in an accident.

- Check Under the Hood: Open the hood and inspect the engine bay for any leaks, corrosion, or worn components. Check the fluid levels, including engine oil, coolant, brake fluid, and power steering fluid.

- Inspect the Interior: Check the interior for signs of wear and tear, such as stains, tears, or unusual odors. Test all the features and controls to ensure they work properly, including the air conditioning, heating, and audio system.

- Undercarriage Inspection: If possible, inspect the underside of the car for any signs of damage, rust, or leaks. Look for any loose or damaged components, including exhaust systems, suspension components, and fuel lines.

- Test Drive Again: If you’re considering a used car, take it for a second test drive after the inspection to ensure that any issues identified during the inspection have been addressed and to confirm that the car still meets your expectations.

- Obtain a Professional Inspection: Consider hiring a qualified mechanic or automotive technician to perform a comprehensive inspection of the car, especially for used cars. They can identify any hidden issues or potential problems that may not be apparent during a visual inspection.

By conducting thorough test drives and inspections, you can make a more informed decision when purchasing a car and avoid potential headaches or costly repairs down the road.

Negotiating the Price

Negotiating the price of a car is a crucial step in the car buying process and can potentially save you a significant amount of money. Here are some tips for negotiating the price effectively:

- Research: Do your homework before negotiating by researching the fair market value of the car you’re interested in. Use online resources, such as pricing guides and car valuation websites, to determine the average selling price for similar makes, models, and trim levels in your area.

- Set a Budget: Determine your budget for the car purchase and stick to it during negotiations. Consider factors such as down payment, monthly payments, insurance, taxes, and other associated costs to establish a realistic budget.

- Know Your Worth: Understand your worth as a customer and leverage it during negotiations. If you’re a loyal customer, have excellent credit, or are willing to make a sizable down payment, use these factors to negotiate a better deal.

- Be Prepared to Walk Away: Don’t be afraid to walk away from a deal if the price isn’t right or if the dealer is unwilling to negotiate. Being prepared to walk away can give you leverage and pressure the dealer to offer a better deal.

- Start Low, Aim High: Begin negotiations with a lower offer than the asking price, but be prepared to increase your offer gradually. Aim for a final price that is lower than your budget to leave room for negotiation.

- Highlight Flaws: Point out any flaws or imperfections in the car, such as cosmetic damage, mechanical issues, or missing features, to justify a lower price. Use this information to negotiate a discount or additional incentives.

- Negotiate in Person: Whenever possible, negotiate the price of the car in person rather than over the phone or via email. Face-to-face negotiations allow for better communication and a more personalized approach.

- Stay Firm but Polite: Be assertive in your negotiations but remain polite and respectful throughout the process. Avoid getting emotional or confrontational, as this can hinder productive discussions.

- Consider Additional Incentives: In addition to negotiating the price of the car, consider asking for additional incentives such as free maintenance, extended warranties, or accessories to sweeten the deal.

- Get Multiple Quotes: Shop around and obtain quotes from multiple dealerships to compare prices and leverage competitive offers during negotiations. Use quotes from other dealerships to negotiate a better deal with your preferred dealer.

- Review the Details: Carefully review and negotiate all the details of the deal, including financing terms, trade-in value, add-ons, fees, and any other charges. Make sure everything is clearly outlined in writing before finalizing the agreement.

- Be Patient: Negotiating the price of a car may take time, so be patient and persistent throughout the process. Don’t rush into a deal unless you’re confident it meets your budget and requirements.

By following these tips and strategies, you can negotiate the price of a car effectively and secure a better deal that fits within your budget and preferences.

Understanding Ownership Costs

Understanding ownership costs is essential for budgeting and making informed decisions when purchasing a car. Ownership costs include various expenses associated with owning and maintaining a vehicle over its lifespan. Here are the key components of ownership costs:

- Purchase Price: The initial cost of purchasing the car, including the negotiated price, taxes, registration fees, and any additional charges.

- Depreciation: The decrease in the car’s value over time due to factors such as age, mileage, and wear and tear. Depreciation is one of the most significant costs of car ownership, particularly for new cars.

- Financing Costs: If you finance the car purchase with a loan, you’ll incur financing costs such as interest payments and loan origination fees. The total financing costs depend on the loan amount, interest rate, and loan term.

- Insurance Premiums: The cost of insuring the car against damage, theft, liability, and other risks. Insurance premiums vary depending on factors such as the car’s make and model, your driving history, age, location, and coverage options.

- Fuel Expenses: The cost of fueling the car, which depends on factors such as fuel efficiency, driving habits, fuel prices, and mileage. Regularly fueling up your car can be a significant ongoing expense, particularly if you have a gas-guzzling vehicle or long commute.

- Maintenance and Repairs: The cost of routine maintenance, such as oil changes, tire rotations, brake replacements, and fluid flushes, as well as unexpected repairs due to mechanical breakdowns or wear and tear. Maintenance costs vary depending on the car’s make and model, age, mileage, and maintenance schedule.

- Taxes and Fees: Ongoing taxes and fees associated with owning a car, such as annual vehicle registration fees, property taxes, and emissions testing fees. These costs vary depending on your location and local regulations.

- Parking and Tolls: Expenses related to parking fees, tolls, and other road usage charges. These costs can add up, especially if you live in an urban area with expensive parking rates or frequent toll roads.

- Warranty and Extended Protection Plans: The cost of purchasing extended warranties or protection plans to cover repairs and maintenance beyond the manufacturer’s warranty period. While these plans can provide peace of mind, they come with additional costs that should be factored into your ownership budget.

- Resale Value: Consider the car’s resale value when calculating ownership costs. Cars with high resale value retain their value better over time, reducing the overall cost of ownership.

When evaluating ownership costs, it’s essential to consider both short-term and long-term expenses to make an informed decision about which car best fits your budget and lifestyle. Be sure to research and estimate each component of ownership costs based on your specific circumstances to ensure that you can afford the ongoing expenses associated with owning the car.

Documentation and Legalities

Documentation and legalities play a crucial role in the car buying process to ensure that the transaction is legal, transparent, and properly documented. Here are the key documents and legal aspects to consider when buying a car:

- Vehicle Registration Certificate (VRC): The VRC, also known as the car’s registration card or logbook, contains essential information about the vehicle, including the owner’s name, address, vehicle identification number (VIN), engine number, registration number, and other details. Make sure the VRC is genuine and matches the information provided by the seller.

- Sales Agreement or Bill of Sale: A sales agreement or bill of sale is a legal document that outlines the terms and conditions of the car sale, including the purchase price, payment method, vehicle details, warranties, and any additional agreements between the buyer and seller. Both parties should review and sign the sales agreement to formalize the transaction.

- Receipt of Payment: Obtain a receipt or proof of payment from the seller to confirm that you’ve paid for the car. The receipt should include details such as the purchase price, payment method, date of sale, and signatures of both parties.

- Certificate of Insurance: Before driving the car off the lot, ensure that you have valid insurance coverage for the vehicle. The certificate of insurance serves as proof of insurance and may be required by law to register the car.

- Transfer of Ownership: If you’re buying a used car, the seller must transfer ownership of the vehicle to you. This typically involves completing and signing the appropriate sections of the VRC, notifying the relevant authorities, and paying any transfer fees or taxes.

- Road Tax and Registration Fees: Ensure that road tax and registration fees are paid up to date before taking ownership of the car. These fees are necessary for legally driving the vehicle on public roads and highways.

- Vehicle Inspection Report: If you’re buying a used car, consider obtaining a vehicle inspection report from a qualified mechanic or automotive technician. The inspection report provides an assessment of the car’s condition, identifying any existing issues or potential problems that may require attention.

- Finance Agreement (if applicable): If you’re financing the car purchase with a loan, review and sign the finance agreement provided by the lender. The finance agreement outlines the terms of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or charges.

- Manufacturer’s Warranty and Service Records: If you’re buying a new car, review the manufacturer’s warranty coverage and ensure that you receive all relevant documents, including the warranty booklet and owner’s manual. For used cars, request service records and documentation of any warranty coverage or repairs performed by the previous owner.

- Title Transfer and Liens: Ensure that the car’s title is transferred to your name and that there are no outstanding liens or encumbrances on the vehicle. The title transfer process varies depending on your location and local regulations.

- Compliance with Regulations: Make sure that the car purchase complies with all applicable laws, regulations, and safety standards in your jurisdiction. Familiarize yourself with any specific requirements or procedures for registering and titling a car in your area.

- Seller’s Disclosure Statement (if required): In some jurisdictions, sellers are required to provide a disclosure statement detailing any known defects, damage, or issues with the vehicle. Review the disclosure statement carefully and ask questions about any concerns before finalizing the purchase.

By ensuring that all necessary documentation and legalities are in order, you can complete the car buying process smoothly and confidently, knowing that you’ve complied with all legal requirements and protected your interests as a buyer. If you’re unsure about any aspect of the documentation or legalities involved in buying a car, consider seeking advice from a legal professional or automotive expert.

Frequently Asked Questions

Your question Buy a Car in Malaysia?

Which question will you have about this car? Let’s justify these. There we are including the major questions and answers about this car. So, let’s start now.

Malaysia boasts a diverse automotive market, with popular brands including Proton, Perodua, Honda, Toyota, and many others.

Yes, the Malaysian government occasionally provides incentives and rebates for the purchase of eco-friendly and energy-efficient vehicles.

Yes, expatriates are allowed to purchase cars in Malaysia. However, certain documentation and requirements need to be fulfilled.

Road tax in Malaysia is calculated based on the engine capacity of the vehicle. The rates vary depending on the size of the engine.

Third-party insurance coverage is mandatory for all car owners in Malaysia. Additional comprehensive coverage is optional but recommended.

Some banks in Malaysia offer special financing packages or lower interest rates for first-time car buyers. It’s advisable to inquire about such options.

The car registration process typically takes a few weeks, and it involves submitting required documents to the relevant authorities.

Buying a car in Malaysia can be a rewarding experience with careful planning and research. By considering key factors, adhering to legal requirements, and staying informed, you can make a well-informed decision and enjoy the journey of owning a vehicle in this vibrant Southeast Asian nation.