Unlocking the Secrets to Finding the Cheapest Car Insurance in Malaysia

In today’s fast-paced world, having car insurance is not just a legal requirement but a crucial aspect of responsible vehicle ownership. For residents in Malaysia, finding the cheapest car insurance that meets your needs can be a game-changer. In this comprehensive guide, we will navigate through the intricacies of securing the most affordable car insurance in Malaysia without compromising on coverage.

Key Factors Influencing Car Insurance Costs in Malaysia

1. Vehicle Type and Model

The type and model of your vehicle play a significant role in determining insurance premiums. High-end cars may attract higher premiums due to their repair and replacement costs.

2. Personal Driving Record

Maintaining a clean driving record can result in lower insurance costs. Safe drivers with no history of accidents or traffic violations are often rewarded with more affordable premiums.

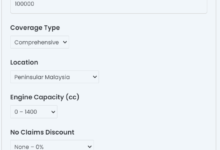

3. Coverage Type

Understanding the types of coverage available is essential. While comprehensive coverage offers extensive protection, opting for basic coverage might be a cost-effective choice for some drivers.

4. No-Claim Discounts

Many insurance providers in Malaysia offer no-claim discounts to policyholders who have not filed any claims during a specific period. Accumulating these discounts can significantly reduce your premium.

Tips for Finding the Cheapest Car Insurance

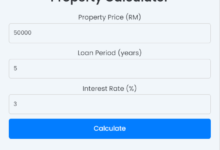

1. Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from different providers to ensure you’re getting the best deal.

2. Bundle Policies

Consider bundling your car insurance with other policies, such as home or health insurance. Many providers offer discounts for bundled packages.

3. Increase Deductibles

Opting for a higher deductible can lower your premium. However, make sure you can comfortably cover the deductible amount in case of a claim.

4. Install Security Features

Installing security features such as anti-theft devices or alarms can lower the risk of theft, potentially leading to reduced insurance premiums.

Frequently Asked Questions

Several factors influence car insurance costs, including the type of vehicle, driving record, coverage type, and eligibility for no-claim discounts.

To find the cheapest car insurance, compare quotes from different providers, consider bundling policies, increase deductibles, and install security features.

While comprehensive coverage offers extensive protection, it may not be necessary for everyone. Assess your needs and budget before deciding on the coverage type.

Yes, you can negotiate with insurance providers. Be proactive in seeking discounts and inquire about available promotions or loyalty rewards.

Yes, no-claim discounts can significantly reduce car insurance premiums. Maintain a clean driving record to maximize these discounts over time.

If you’re struggling with premium payments, consider adjusting coverage, increasing deductibles, or exploring discounts to make the insurance more affordable.

It’s advisable to review and update your car insurance policy annually or whenever there are significant changes in your driving habits, vehicle, or personal circumstances.

Finding the cheapest car insurance in Malaysia requires careful consideration of various factors. By understanding the key influencers, following money-saving tips, and exploring frequently asked questions, you can make informed decisions to secure affordable and reliable car insurance coverage.